Helpful Healthcare Terms: Out-of-Pocket Costs

Insurers sometimes use complicated terms to describe your benefits. We understand that dealing with insurance can be especially confusing when you already have so much on your mind.

That’s why we’re untangling some of those terms for you here so you can focus on what matters most—your health and wellness.

Below, we’ve provided some components included in every insurance plan. Understanding these components may help you navigate your current insurance plan and prepare you for the costs you may owe throughout the year.

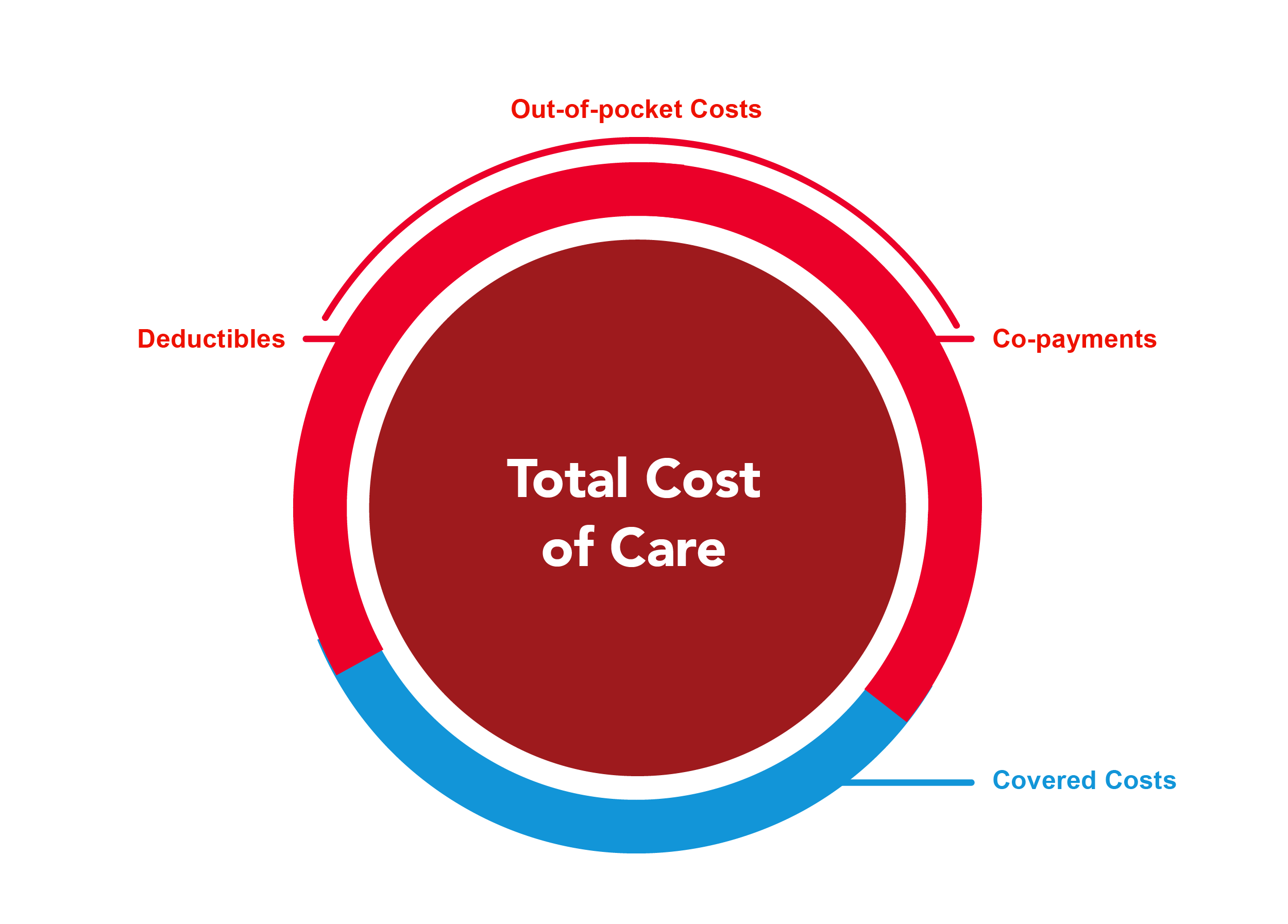

Note: This chart is for illustrative purposes only and is not intended to represent a specific percentage of costs.

Out-of-Pocket Costs

These are expenses for medical care that aren’t paid for by your insurance plan.

Deductibles

The amount of money you must spend out-of-pocket before your insurance provider begins to pay. Health insurance deductibles are based on the calendar year and reset in January.

This means you may be paying more for health expenses at the beginning of the year. However, once your deductible is met, your insurance will pick up more or all of the costs depending on your plan.

Co-payment

This is a set dollar amount you pay after you’ve met your deductible. Commonly referred to as “co-pays,” these can vary by services covered within your plan (like visiting a specialist vs your primary care physician).

In general, if your plan has lower monthly premiums, you will have higher co-payments and vice versa. Higher monthly premiums therefore usually mean lower co-payments.

Co-payments are an out-of-pocket cost, like deductibles, co-insurance (percentage of covered medical expenses you pay after you meet your deductible), and any costs for services that are not covered by your plan.

If you need additional help understanding your insurance plan, you can always reach out to your Takeda Oncology Here2Assist® case manager.

11/23 USO-XMP-0449